Are You Making These 5 Common Small-Business Financing Mistakes?

Most businesses need financing at some point in time.

That’s normal. The problem is that most business owners aren’t financing experts, so it’s easy to make mistakes in the process.

Check out this article “Avoid These 5 Common Small-Business Financing Mistakes” by Eyal Lifshitz and learn some of the common mistakes…

When taking on financing as a small business, the correct course of action always hinges on answering this question: what am I trying to accomplish?

The thing is, financing decisions don’t exist in a vacuum. Small businesses often miss the vital details when assessing whether to borrow or not, such as the full financing cost, the drain on their time, the opportunity costs and baked-in fees.

The right financing option varies for every company, but there are five areas where I see small businesses frequently make financing mistakes. Here are the common pitfalls and the best ways to avoid them so your small business can choose the best option at each stage of your company’s growth.

1. Be aware of your real interest rate. Surprisingly often, people who think they know how to calculate interest rates often don’t…

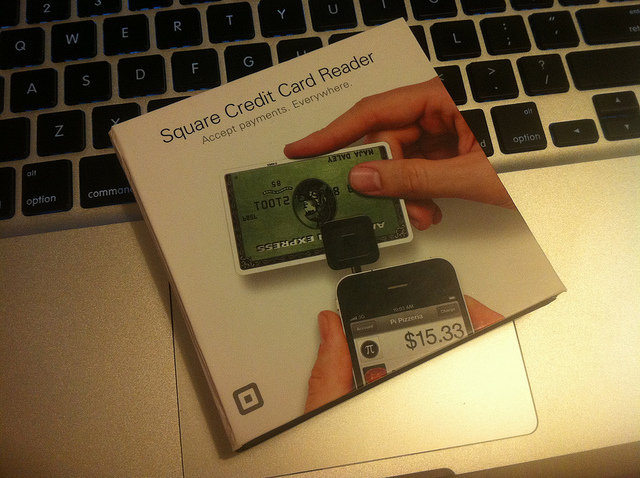

Photo by bfishadow

Related article

- Small Business Owners: Here Are 5 Money-Saving Tips (baybusinesshelp.com)